Politics

Senate Scraps EV Tax Credit in Latest GOP Budget Bill

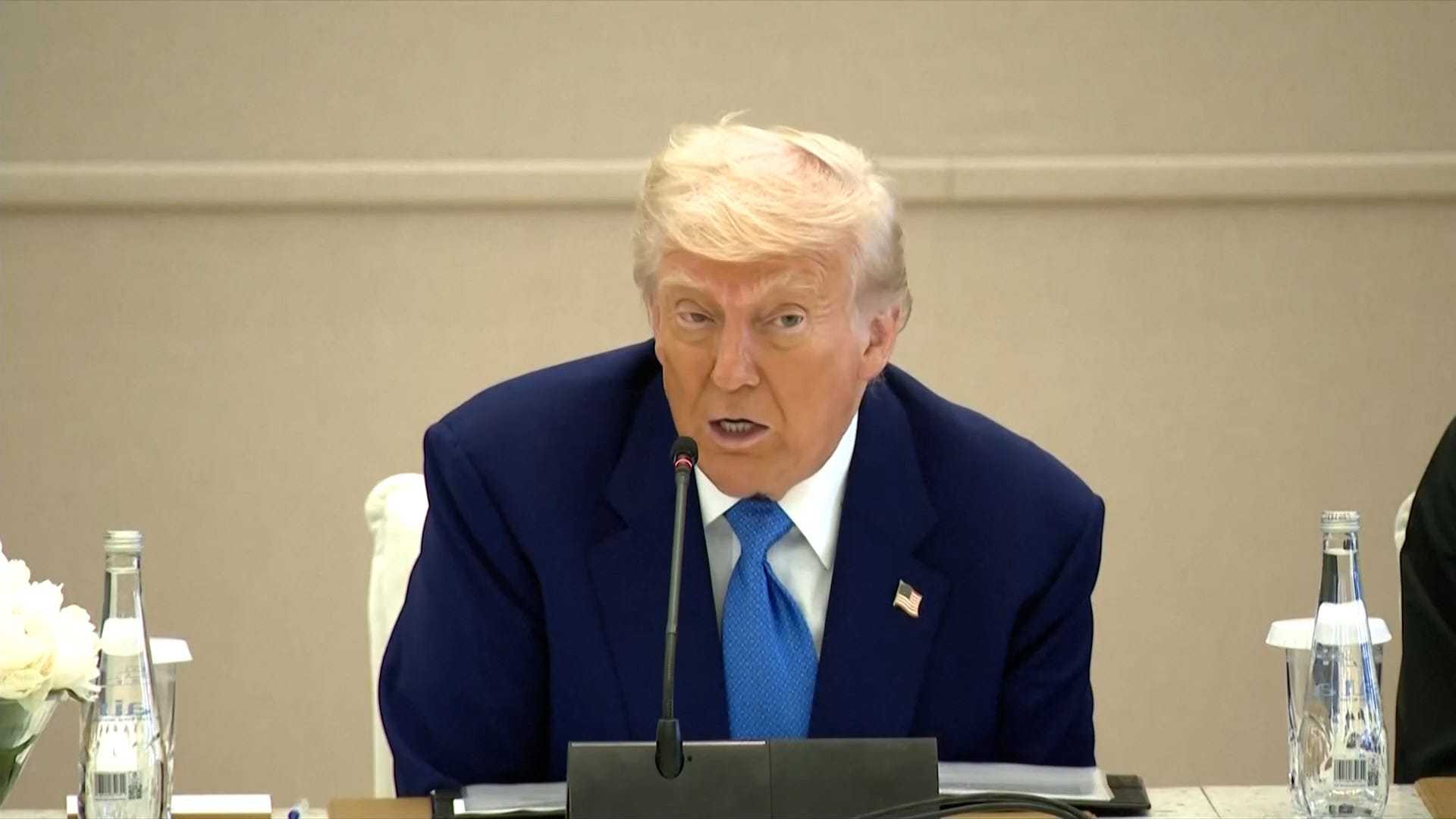

Washington, D.C. — In a major shift, Senate Republicans have revised former President Donald Trump’s tax and budget proposal, eliminating the $7,500 tax credit for electric vehicles (EVs) by the end of September 2025. This change marks a significant move as the Senate finalizes its version of what has been termed Trump’s Big Beautiful Bill, which previously passed the House.

The bill’s new stipulation will end the electric vehicle tax credit, initially set to phase out 180 days post-signing. Earlier expectations aimed for a July 4 deadline, allowing automakers with fewer than 200,000 EVs delivered in the U.S. to retain incentives temporarily. However, the updated bill goes further, explicitly removing the credit altogether by September 30, 2025.

The Senate’s updated legislation also accelerates the reduction of incentives for renewable energy sources, such as solar and wind, while introducing higher taxes on materials sourced from China. Critics argue that these changes favor the fossil fuel industry and disregard renewable energy initiatives.

Elon Musk, CEO of Tesla, has expressed surprise at these developments, despite previous Republican campaigning on cutting EV incentives. Analysis indicates that, ironically, Tesla could be most affected despite Musk’s financial support for Trump and the GOP.

Experts warn that the U.S. is already trailing behind other nations in EV adoption. The abolishment of the tax credit could further widen this gap, hindering domestic competition in an increasingly globalized auto market. With Tesla’s sales facing challenges and production concerns, analysts suggest potential profitability issues may arise as early as the fourth quarter of 2025 if the bill is passed.