Business

U.S. Treasury Yields Fall Amid Inflation Data and Trade Concerns

NEW YORK, NY – U.S. Treasury yields dipped on Wednesday following the release of the producer price index, which indicated a slowdown in inflation for June. Shortly after 8:30 a.m. ET, the 10-year note yield fell approximately two basis points to 4.465%. Meanwhile, the 30-year yield also decreased by the same amount to 4.996%, and the two-year note yield dropped slightly to 3.929%.

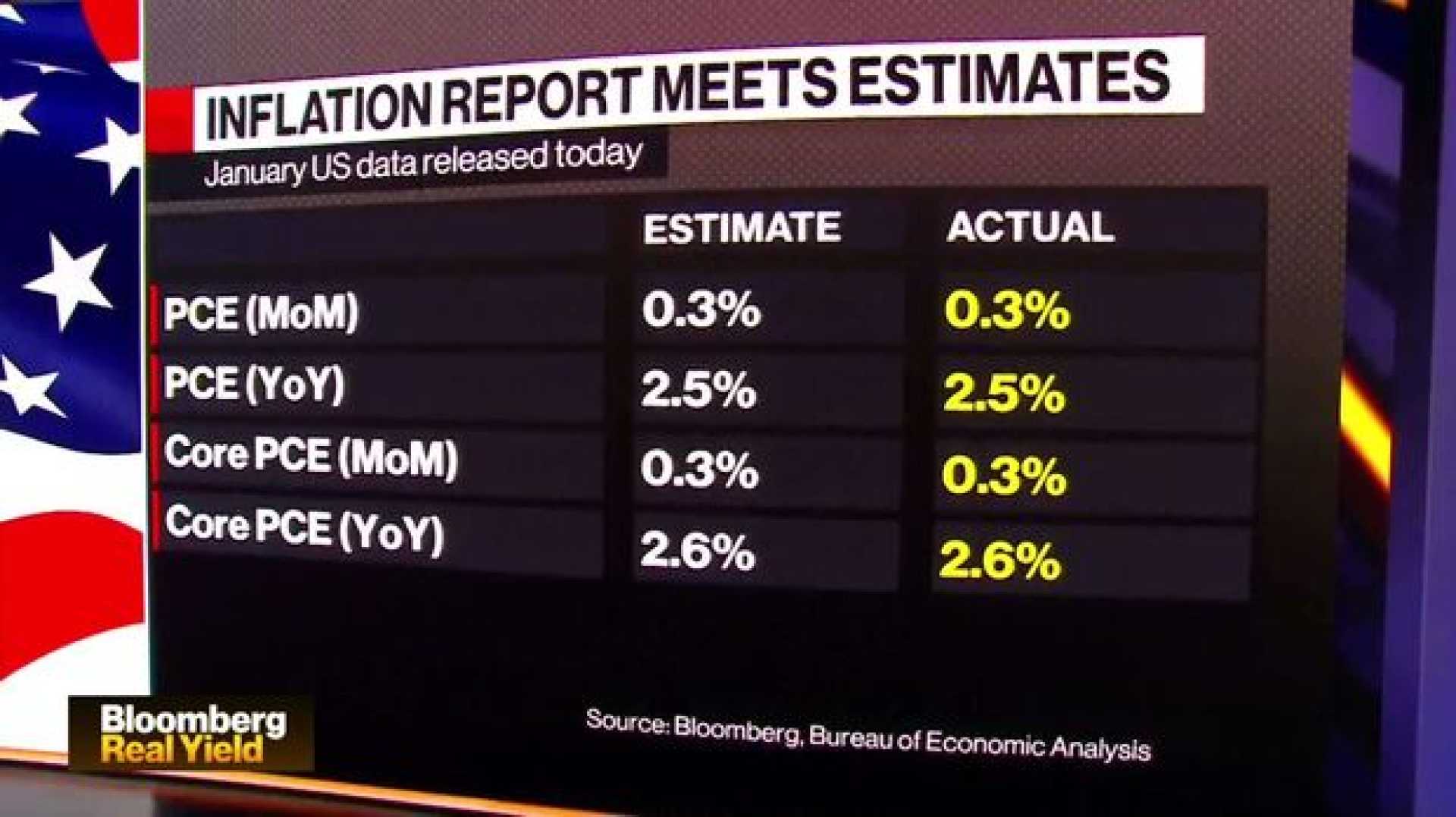

The producer price index remained unchanged for June, contrary to economists’ expectations of a 0.2% monthly increase, according to Dow Jones estimates. This pause in inflation follows Tuesday’s consumer price index report, which showed a core CPI increase of 0.2% month-over-month and 2.9% year-over-year. While this monthly change was slightly below expectations, the yearly figure was in line with Dow Jones consensus.

Joe Brusuelas, chief economist at RSM U.S., noted, “Inflation has started a slow climb as signs of tariff-induced inflation are now evident within durable and nondurable imports.” He posed a critical question regarding whether easing service and housing inflation could offset a potential rise in durable and nondurable goods prices.

Investors are keeping a close watch on the effects of President Donald Trump’s tariffs on the U.S. economy, especially after he announced recently imposed 30% tariffs on Mexico and the EU, starting from August 1. Furthermore, Trump confirmed that the U.S. has reached a trade deal with Jakarta, implementing a 19% tariff on its exports to the U.S.

On the global equities front, MSCI’s worldwide index lost ground on Tuesday following a record high, while major U.S. indices fluctuated as they absorbed recent inflation updates and mixed quarterly results from significant banking institutions.

The Dow Jones Industrial Average saw a decline of 436.36 points, or 0.98%, to close at 44,023.29. The S&P 500 and Nasdaq Composite similarly faced setbacks, dropping by 24.80 points and 20.36 points, respectively. The negative movements persisted in response to concerns surrounding tariff-related inflation.

In conclusion, the latest economic indicators continue to reflect uncertainty amidst ongoing adjustments to trade policies and broader inflation trends.