Business

CrowdStrike Stock Downgraded Amid Changing Market Dynamics

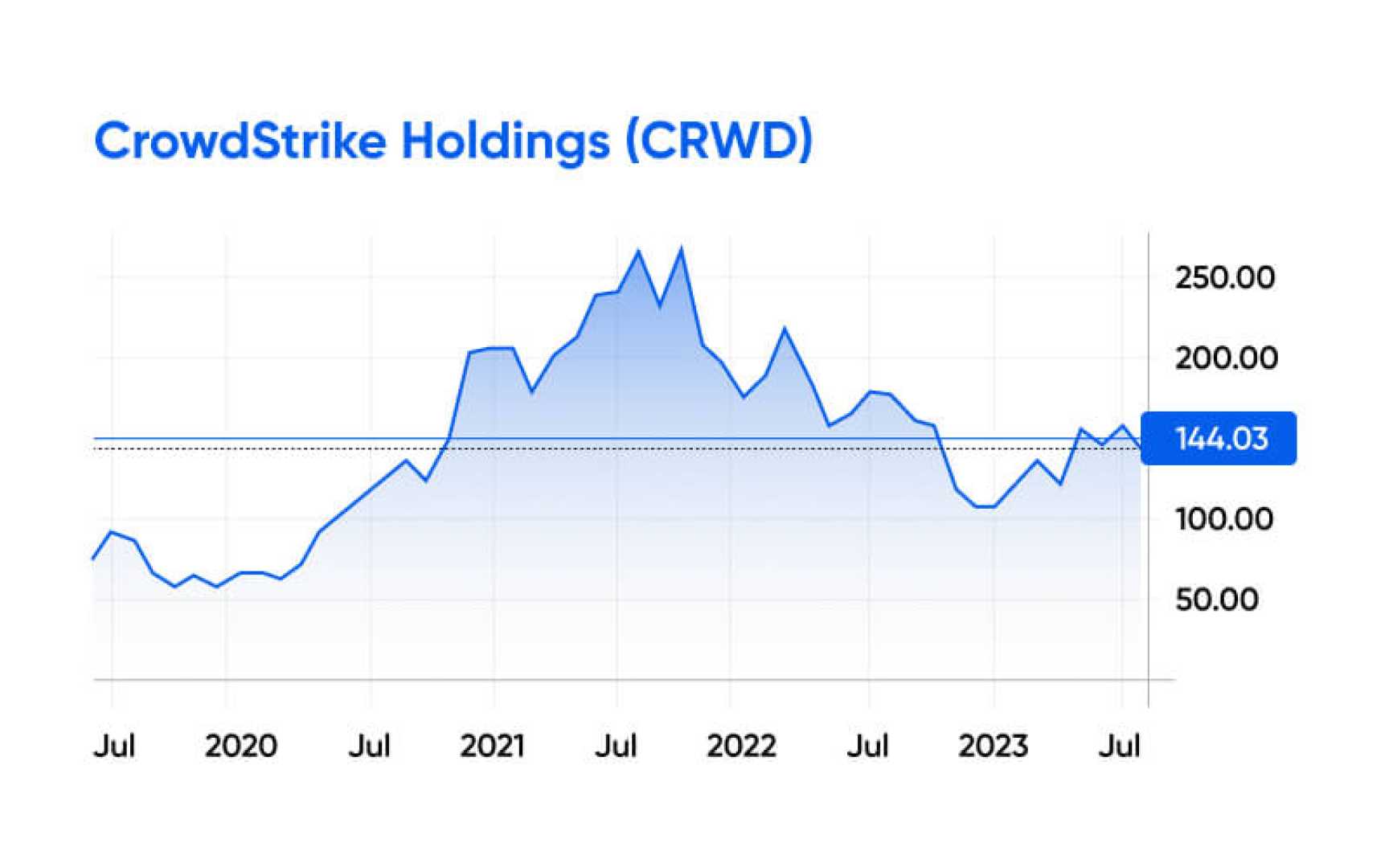

NEW YORK, NY — On July 7, CrowdStrike Holdings, Inc. (NASDAQ: CRWD) experienced a downgrade from the investment firm Piper Sandler. Analyst Rob Owens lowered the stock rating from ‘Overweight’ to ‘Neutral,’ maintaining a price target of $505. This adjustment reflects the firm’s belief that there are no imminent catalysts that could significantly boost CrowdStrike’s financial performance.

Owens noted, “We do not anticipate a near-term scenario that would drive numbers higher or increase its terminal multiple.” He advised investors to refrain from adding shares at this time, citing limited short- to medium-term upside.

CrowdStrike is recognized for its leading position in AI-driven endpoint and cloud workload protection. However, analysts suggest that some competitors in the AI sector may offer greater potential for higher returns in a shorter timeframe.

Artificial intelligence continues to dominate conversations in the investment world, with claims about it being a primary driver of future innovation and efficiency. Some analysts predict that the demand for AI technologies will lead to significant energy consumption challenges, raising questions about sustainability and infrastructure needs.

Industry experts like Sam Altman, founder of OpenAI, have acknowledged these concerns, emphasizing the urgent requirement for energy breakthroughs to support AI’s demanding energy needs. This evolving landscape presents a complex mix of opportunities and challenges for investors.

As the economic environment shifts, CrowdStrike remains a focus within security and IT sectors, yet market players are urged to consider other options that may provide more immediate benefits. The overall guidance suggests a cautious approach while monitoring the long-term viability of companies within the AI space.