Business

New U.S. Tariffs Aim to Address Trade Deficits

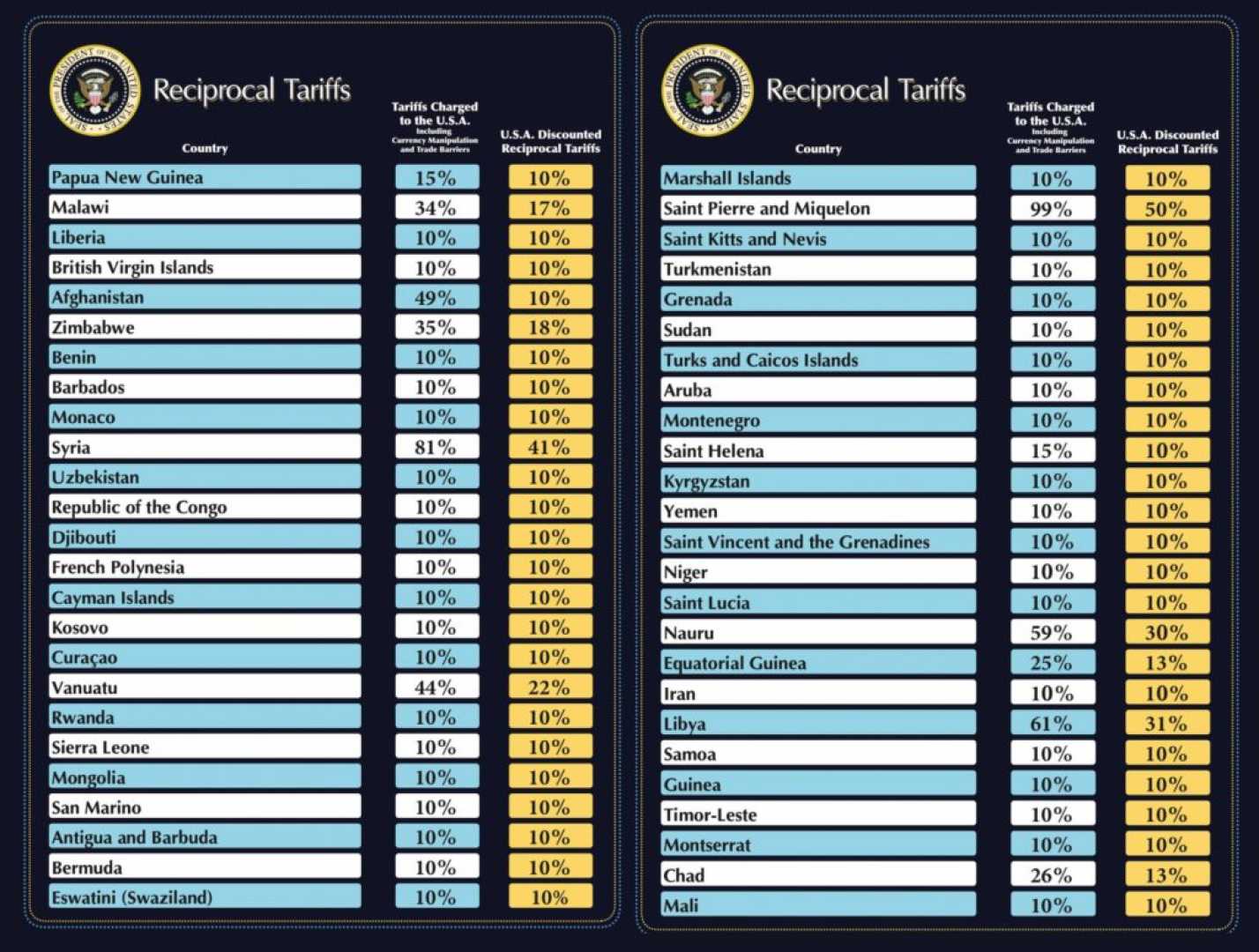

WASHINGTON, D.C. — On April 2, 2025, President Donald J. Trump announced a series of reciprocal tariffs designed to address significant trade deficits between the United States and various countries. These tariffs, ranging from 10 percent to 50 percent, aim to rectify the imbalance caused primarily by non-reciprocal trade practices and disparate tariff rates.

The administration’s initiative stems from a national security declaration, citing that persistent annual U.S. goods trade deficits, which reached $1.2 trillion in 2024, threaten the nation’s economic stability. This decision aligns with the president’s ongoing commitment to bolster domestic manufacturing, which has seen significant declines over the past two decades.

Trump emphasized that these tariffs follow an extensive review of trade practices, stating, “The lack of reciprocity in our bilateral trade relationships and suppressive economic policies from key trading partners jeopardize our manufacturing base and, ultimately, our national security.” The tariffs are regarded as a necessary measure to re-balance trade flows, improve domestic production capabilities, and decrease reliance on foreign goods.

The newly established tariff rates will begin at a base of 10 percent on imports from all countries, escalating for specific trading partners based on their trade surplus with the U.S. For example, the tariff on imports from China will be 34 percent, while the European Union will face a 20 percent tariff. This approach reflects the administration’s belief that higher tariffs on countries with trade surpluses will pressure them to adopt more reciprocal practices.

Economic analysts have raised concerns about the potential fallout from these tariffs. They argue that while the intention is to lessen trade deficits, increased tariffs could result in higher prices for American consumers and may provoke retaliatory measures from trading partners, which could worsen the situation. According to a report from the Tax Foundation, the cumulative effect of the Trump tariffs could total approximately $3.1 trillion over a decade, translating to a potential $2,100 tax increase per household by 2025.

Moreover, the tariffs, which range from 0 to 99 percent depending on the country, are derived from an analysis of U.S. Census Bureau data. The model calculates the rates necessary to eliminate trade deficits based on various parameters, including import prices and the elasticity of demand. The administration’s methodology has faced criticism for its reliance on the trade balances as a proxy for trade barriers and tariffs imposed by partner countries.

Trump asserted that long-standing assumptions within international trade theory that bilateral trade would self-correct over time have proven incorrect for the U.S., which has experienced persistent deficits for over five decades. He argued that these deficits are not solely economic but reflect deep-rooted structural problems in global trade, exacerbated by regulatory barriers, compliance costs, and fundamentals that hinder American exports.

The administration faces opposition from critics who contend that the imposition of tariffs without measuring other countries’ actual trade practices could lead to unintended economic consequences. They warn that the entire approach may ignore the contributions that services and intangibles play in bilateral trade and the intricate supply chains that characterize modern commerce.

“This strategy oversimplifies complex trade dynamics,” stated economist Christoph E. Boehm, expressing concerns over the administration’s reliance on direct correlation between trade deficits and tariff imposition. “Bilateral balances do not reflect the full picture of international economics and can lead to misguided policies.”

The economic impact of these tariffs will be evaluated as they begin to take effect starting on April 5, 2025. The administration plans to monitor results closely while calling upon members of the public and private sectors to support domestic manufacturing efforts. As the trade landscape evolves, the effects of these tariffs will play a vital role in shaping future trade relations.